Egypt to issue EGP 2.36trn in local debt instruments in Q1 of FY2025/2026

The Egyptian government plans to issue EGP 2.36trn in local debt instruments during the first quarter of fiscal year 2025/2026 to cover maturing obligations and finance the state budget deficit.

According to figures released by the Ministry of Finance, the plan includes 56 treasury bill (T-bill) auctions worth EGP 2.05trn and 47 bond auctions totalling EGP 308.5bn between July and the end of September. The Central Bank of Egypt (CBE), which conducts the issuances on behalf of the government, will offer T-bills and bonds worth EGP 850.5bn in July, EGP 670bn in August, and EGP 838bn in September.

As part of the quarterly plan, the Ministry will issue 91-day T-bills worth EGP 340bn, 182-day bills worth EGP 520bn, 273-day bills worth EGP 525bn, and 364-day bills worth EGP 665bn. On the bond side, scheduled offerings include EGP 77bn in two-year bonds, EGP 169bn in three-year bonds, and EGP 43bn in floating-rate bonds of the same tenor. The Ministry will also issue EGP 10bn in five-year bonds and EGP 9.5bn in floating-rate five-year instruments.

Banks operating in the Egyptian market remain the largest investors in government-issued T-bills and bonds, which are a key tool for financing the budget deficit. These debt instruments are issued through 15 banks within the primary dealers system, which also allows them to trade the securities on the secondary market to both local and foreign institutional and individual investors.

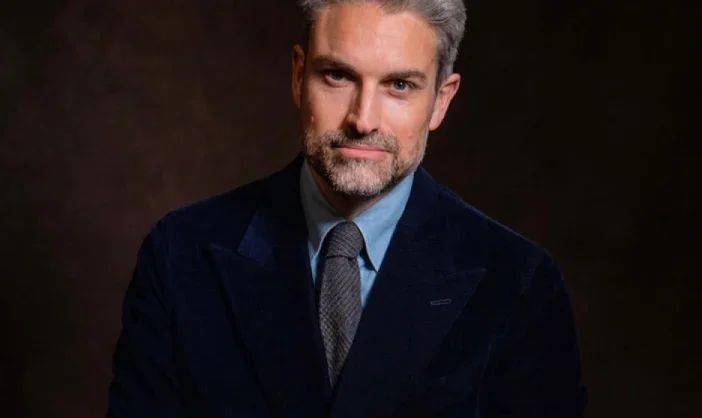

Prime Minister Mostafa Madbouly reaffirmed the government’s ongoing efforts to reduce public debt, noting that Egypt has achieved primary budget surpluses for five consecutive years, including a 3.5 percent surplus of GDP in the current fiscal year. He said these efforts, along with other fiscal measures, helped bring down the debt-to-GDP ratio from 96 percent in June 2023 to approximately 90 percent in June 2024. The government aims to further reduce this ratio to 86 percent by the end of FY2024/2025.

Madbouly emphasised that Egypt is committed to sustaining the downward trajectory of public debt in the years ahead.